Fidelity 401k loan payment calculator

Use Fidelity Bank calculators to help you with. Amortizing Loan Calculator Enter your desired payment - and let us calculate your loan amount.

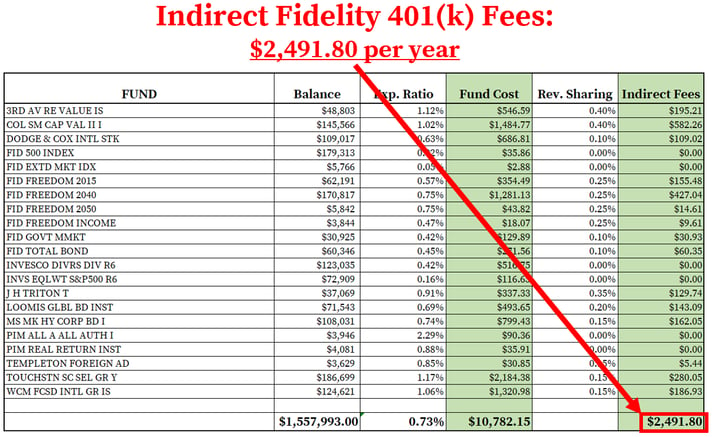

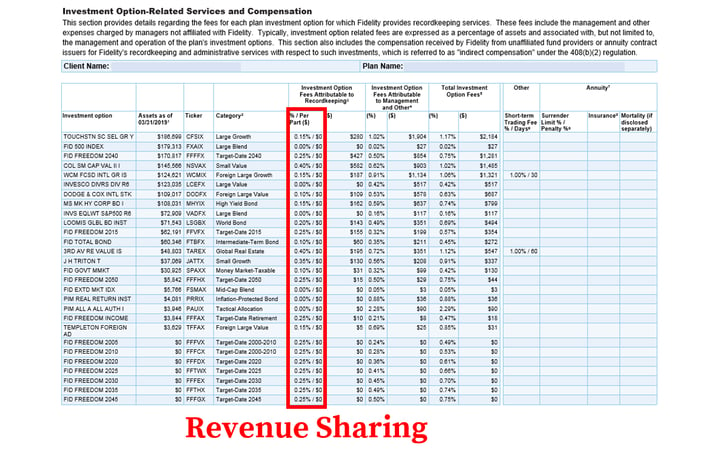

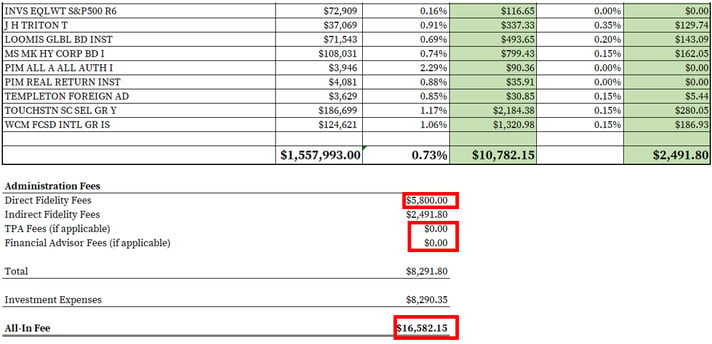

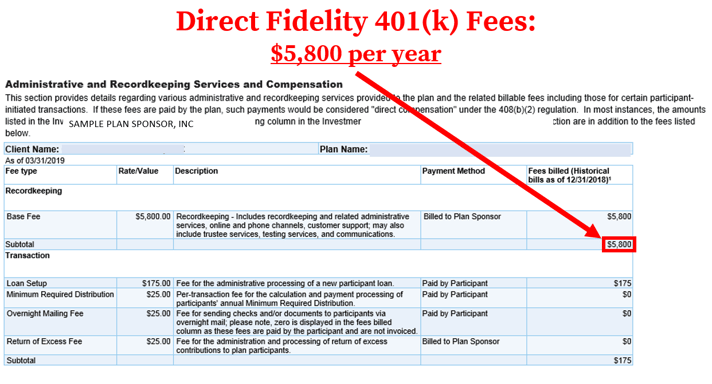

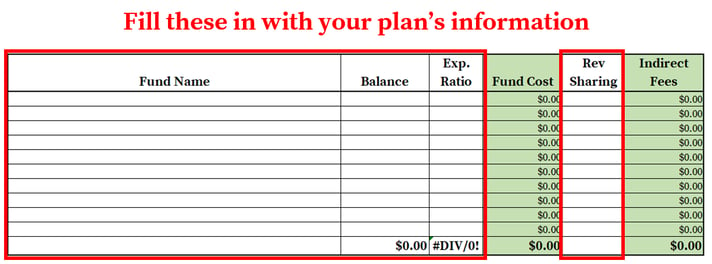

How To Find Calculate Fidelity 401 K Fees

Thinking about taking a loan from your employer plan.

. We would like to show you a description here but the site wont allow us. If you were to consolidate your loans it would cost you 150334. The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place.

You only pay taxes on contributions and earnings when the money is withdrawn. With this tool you can see how prepared you may be for retirement review. Second many employers provide.

If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under. This calculator uses exact days compounding to approximate how much your credit card. If you have an unpaid loan in the former employers plan you can take a new 401k loan with the new employer to pay the.

900 1800 2700 3600 1883 3322 Plan Loan Alternative Loan Foregone investment return Total interest over the term of the loan. Enter your desired payment - and let us calculate your loan amount. Obtain an estimate of what you could afford to borrow with a Fidelity Personal Loan.

You are eligible to begin. Or enter in the loan amount and we will calculate your monthly payment. Home financing mortgage payments loan consolidation leasing payments personal financing auto loan payments college loans.

Note that other pre. This loan payment calculator can be used to figure out monthly payments of a loan based on the loan amount the term of the loan desired and the loans. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000.

Or enter in the loan amount and we will calculate your monthly payment. The dial above shows the percentages of the monthly benefit based on your Full Retirement Age FRA and in one year increments before and after your FRA. First all contributions and earnings to your 401 k are tax-deferred.

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Please be advised that these are indicative amounts and.

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

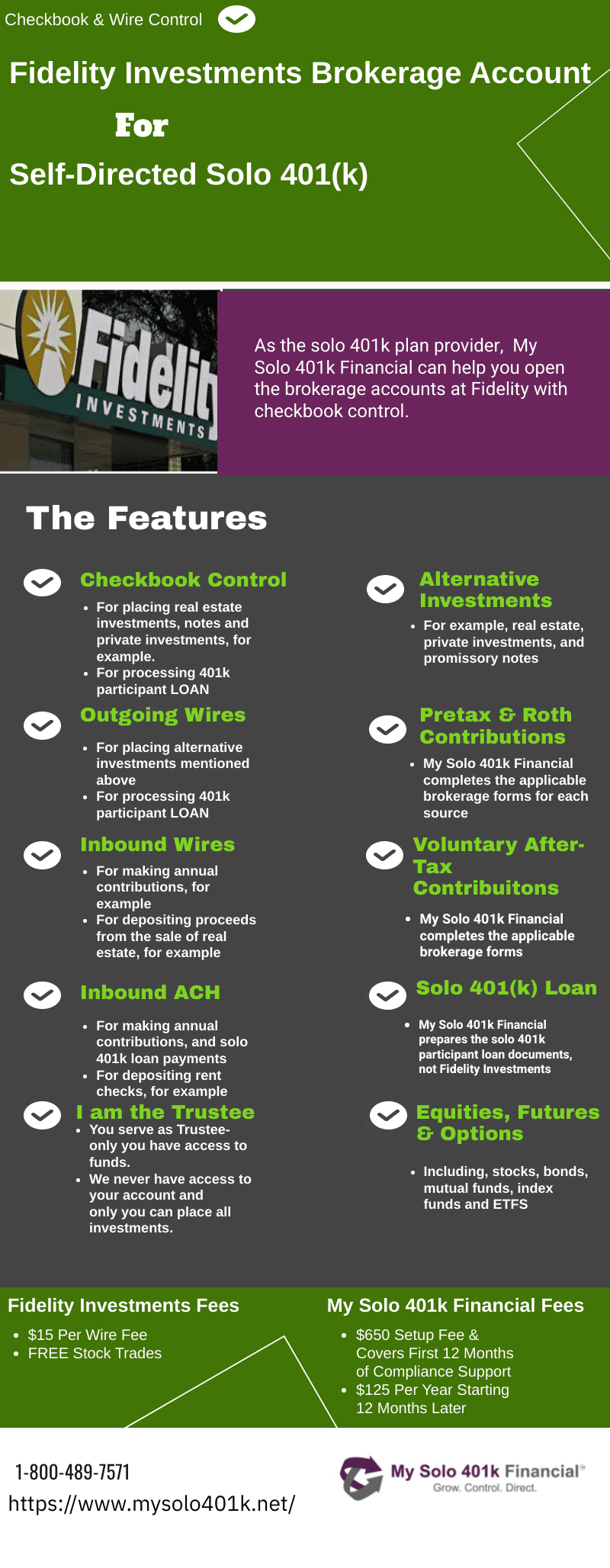

Fidelity Solo 401k Brokerage Account From My Solo 401k

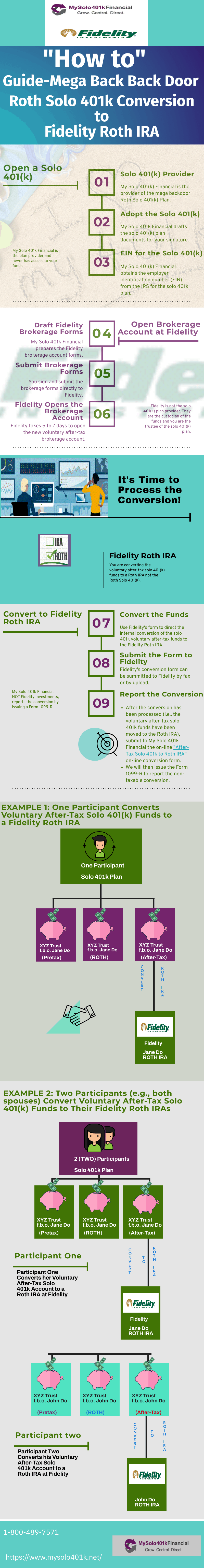

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

How To Find Calculate Fidelity 401 K Fees

Mobile Finance Fidelity

How To Transfer A Former Employer 401k Plan Held At Fidelity Investments To A Self Directed Solo 401k My Solo 401k Financial

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

How To Find Calculate Fidelity 401 K Fees

Financial Calculators Tools Fidelity

How To Find Calculate Fidelity 401 K Fees

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Fidelity Solo 401k Brokerage Account From My Solo 401k

How To Find Calculate Fidelity 401 K Fees

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

How To Find Calculate Fidelity 401 K Fees